Silver has a great deal of potential upside.

There is less silver available today than there was 100 years ago as silver is consumed by industry . Silver is approaching an all time high vs the cost of gold it is 50 times more expensive than gold compared with a multiple of 30 in 1985 and roduction costs for silver when compared Gold is only 17 times as much.

So silver prices could be different if based on

- Gold / Silver price Ratio (at 1985 ratio) $60

- Production cost ratio $105

Buying Silver in the UK

Buying Silver in the UK

The UK charges VAT on owning silver bullion. However there are some ways you can get around this problem. The best solution I have found is to get an investment depository from the Perth Mint. This is VAT free and give you liquidity and security (although not physical possession of the silver) . I think its your best bet if you want to diversify into silver in a safe tax effective way. (I reckon a 50/50 split cash silver would be good)

Numbers and insights to back up my summary above

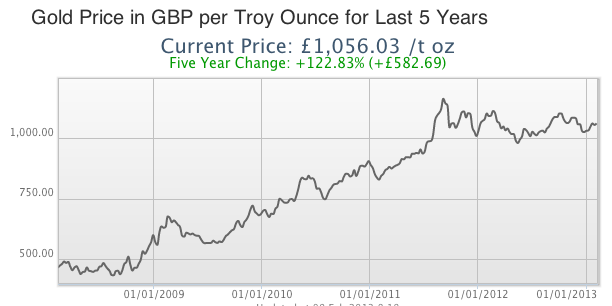

Silver VS Gold – In the last 5 years gold has increase from 500 to 1056 pounds whereas silver has increased from 20 to 30 pounds so comparatively gold has gone up more than silver.

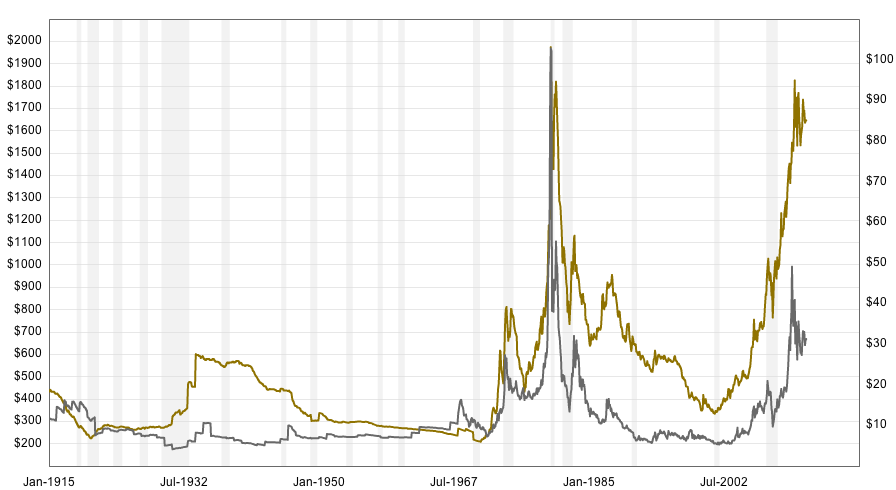

Looking on a longer timeline to see the price ratios over time in US dollars

Look at the ratio of the price of gold versus silver gold:silver

- 1932 600 10 – 60:1 (gold is 60 times more than silver)

- 1967 300 10 – 30:1

- 1985 1900:90 21:1

- 2013 1667: 31.42 53:1

Look at the cost of extraction

- Current Cost $250 per oz

- Current price 1600

- Current miners profit = 1600-250 = 1350 or 650% (profit is 6.5 times cost)

- Current Cost $14 per oz

- Current Price is 28

- Current miners profit = 28-14 = 14 or 200% (profit is twice cost)

This is interesting. This shows a distortion in the market it suggests that gold is overpriced compared to silver

Production

Ratio – Production 2700:255k = 1:94 (there is 94 times as much silver produced as gold)

Gold Production in 2011 was 2700 tonnes

Silver Production 2011 255,000 tonnes

This means that more silver is currently being mined than gold by a larger multiple than that of gold. This would cause downward pressure on the price. Why would silver production be so high compared to gold when the margins are lower? I would suggest that there is something distorting the market. It is either collusion with gold or silver manufacturers or something to do with the speed at which you can setup new gold mines versus silver to cope with demmand.

Availability

In this article they claim that because silver is used up in production processes there is actually less silver above ground than there was 100 years ago.

The basis tells a different story: http://monetary-metals.com/the-coming-silver-correction/

If you look at the basis, which is simply the price of the metal in the futures market minus the price in the spot market, it indicates that silver has a lowering basis indicating oversupply and gold has a rising basis indicating undersupply. The video I linked to above has more detail on the subject. I suggest when betting on the silver supply you look straight to the futures market. It shows no shortage.

Also the most important points to remember is that silver & gold have high stocks to flows, virtually unlimited marginal utility, the smallest bid-ask spread, and are the most marketable goods with gold as the most marketable good. These features make gold and silver monetary metals.

The most important factor is the stocks to flows ratio. It would take 80 years of mining (flows) at current levels to create current stocks. This makes gold an incredibly stable measure of value, more stable than any other commodity, and a better measure of value. Gold does not go up and down in value, the dollar fluctuates in value. The dollar is a poor unit of economic measurement.

Thanks John

I have watched the video and understand what you are saying. Although your analysis seems at odds with mine I think it is possible for both to be correct. I come from a value investing point of view so am trying to understand the intrinsic long term intrinsic worth of silver wheras your analysis points to a the future worth of silver on a shorter term timeline.

I have not looked into the ratio of physical buying Vs futures buying before so you make an interesting point. This could be